Wednesday, August 31, 2011

Annals of the economic elite

"Twenty-five of the 100 highest paid U.S. CEOs earned more last year than their companies paid in federal income tax..."

Via Huffington Post

Tuesday, August 30, 2011

Let the sun shine - a solar success story...

Some good news for a change, via Think Progress:

With all the stories about China dominating the solar photovoltaics (PV) manufacturing sector, you might not think that America is a net exporter of solar products. But it is — to the tune of $1.8 billion. That’s a $1 billion increase over net exports documented in the solar sector last year.

In fact, a report released this morning from GTM Research and the Solar Energy Industries Association found that the U.S. has a $247 million trade surplus with China.

U.S. imports in 2010 were estimated at $1.4 billion, while exports were estimated to be between $1.7 billion – $2.0 billion based on the availability of data for capital equipment sales. This made the U.S. a net exporter of solar goods to China by $247 million to $539 million. Imports came predominantly from modules ($1.2 billion), while exports were driven by capital equipment ($708 million to $1 billion) and polysilicon ($873 million).Solar isn’t just about the module. When looking at polysilicon production, equipment for manufacturing lines, power electronics, solar hot water tanks, and any number of other domestically-produced products, the U.S. actually offers a good-sized contribution to the global market.

The 2011 Solar Energy Trade Assessment is a follow up from last year’s report, which found U.S. net exports in 2009 were worth $723 million.

The $1 billion surge in net exports came during a year when the U.S. solar market grew by over 100%. Due to the successful Treasury Grant Program and Loan Guarantee Program that made it easier for developers and manufacturers to finance facilities, the solar sector grew faster than ever before.

And all that solar — particularly solar PV — brings immense value to the domestic economy.

Monday, August 29, 2011

Setting the record straight: "Three Charts to E-Mail To Your Right-Wing Brother-in-Law"

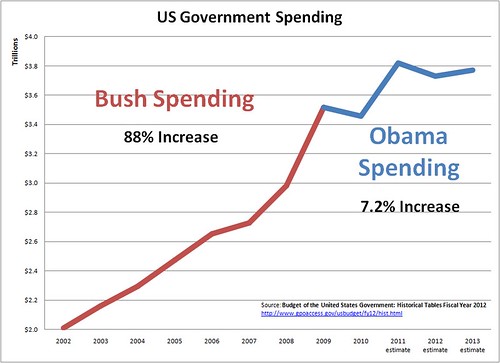

Spending

Government spending increased dramatically under Bush. It has not increased much under Obama. Note that this chart does not reflect any spending cuts resulting from deficit-cutting deals.

Our 21st Century Working Class

Ted Rall via Balloon Juice

Ted Rall via Balloon JuiceMore from David Weisal at WSJ:

There are 13.9 million unemployed people in the U.S. – and that just counts those looking for work. That works out to 9.1% of the labor force, the widely publicized unemployed rate.

But here are a few more ways to look at it.

Sunday, August 28, 2011

"The Mind of the Fed"

David Leonhardt of the The New York Times dissects the limits of debate within the Federal Reserve Bank. (Hint: It has to do with the power of the banks in choosing board members - who could have guessed?):

IF you were to conduct a survey of the country’s top economists, you would find a fair number who did not believe that the Federal Reserve should be taking more aggressive steps to help the economy. Some would worry that injecting more money into the economy might unnerve global investors or set off uncontrollable inflation. Others would wonder whether, with interest rates already so low, the Fed even had much power to lift economic growth.

But you would also find a sizable group of economists who thought the Fed could and should do far more than it was doing. This group, known as doves, tilts liberal, though it includes conservatives as well. If anything, it can probably claim a larger number of big-name economists — J. Bradford DeLong, Paul Krugman (an Op-Ed columnist for The New York Times), Christina D. Romer, Scott Sumner and Mark Thoma, among others — than the camp that believes the Fed has done too much.

You would never know this, however, from listening to the public debate among Federal Reserve officials. That debate is much narrower.

Work Sharing as a stop-gap to extreme unemployment

Dean Baker at Bloggingheads offers an innovative idea to keep the workforce engaged during periods of persistent unemployment.

Saturday, August 27, 2011

Rick Perry, Mitt Romney, David Brooks and the descent into darkness of contemporary "conservatism"

Read THIS "shrill screed" if you read nothing else on politics and our dire straits today.

Via Balloon Juice

"Put jobs at the top of the national agenda..."

President Obama has promised to deliver a jobs agenda in September. Here's a good column by NYT's Nick Kristoff that helps put the jobs crisis in perspective:

When Americans are polled about the issue they care most about, the answer by a two-to-one margin is jobs. The Boston Globe found that during President Obama’s Twitter “town hall” last month, the issue that the public most wanted to ask about was, by far, jobs. Yet during the previous two weeks of White House news briefings, reporters were far more likely to ask about political warfare with Republicans...

2012: On political perspective and drawing lines where they matter the most

Winning Progressive lays out an excellent counter-critique to much of the over-heated criticism of President Obama coming from "the left" that dismisses his accomplishments and commitments:

Friday, August 26, 2011

Why any proposal to raise the Medicare eligibility age is not "fiscally conservative"

2 Charts:

In fact, given the cost-effectiveness of Medicare compared to private insurers, the country would save money on rapidly-inflating medical costs by lowering the Medicare eligibility age, allowing people to buy into the system earlier.

Via Jared Bernstein - "Cost Shifting Is Not Cost Saving"

Via Jared Bernstein - "Cost Shifting Is Not Cost Saving"

Thursday, August 25, 2011

Reducing the costs of Medicare

There are smart, patient-friendly ways to achieve the necessary cost reductions, and dumb ones that put the burden of health-care inflation on seniors...

Some notes on the smart path, HERE.

Wednesday, August 24, 2011

Republicans want to raise your taxes!

Harold Myerson at the Washington Post:

America’s presumably anti-tax party wants to raise your taxes. Come January, the Republicans plan to raise the taxes of anyone who earns $50,000 a year by $1,000, and anyone who makes $100,000 by $2,000.

Their tax hike doesn’t apply to income from investments. It doesn’t apply to any wage income in excess of $106,800 a year. It’s the payroll tax that they want to raise — to 6.2 percent from 4.2 percent of your paycheck, a level established for one year in December’s budget deal at Democrats’ insistence. Unlike the capital gains tax, or the low tax rates for the rich included in the Bush tax cuts, or the carried interest tax for hedge fund operators (which is just 15 percent), the payroll tax chiefly hits the middle class and the working poor.

General Electric's global operations defy "conventional wisdom" about corporate taxes

It's been widely reported that General Electric paid no US taxes last year, despite over $14 billion in profits - and over $5 billion profits reported in the US. GE actually got a $3.2 billion tax credit from the US government.

David Cay Johnston has an interesting column at Reuters about the distribution of GE's tax payments over the last decade that raises some questions about the impact of corporate tax rates on the company's activities. The US has offered GE lower effective tax rates than it's foreign operations, but GE has been reporting more of its profits overseas, where it's been paying higher taxes. (The fact that GE pays much lower taxes than the supposed US corporate tax rate is also instructive.) This trend of their reported profits shifting overseas where the corporate rates are effectively higher for GE counters the "conventional wisdom" about how taxes drive the investment decisions of a major global business:

David Cay Johnston has an interesting column at Reuters about the distribution of GE's tax payments over the last decade that raises some questions about the impact of corporate tax rates on the company's activities. The US has offered GE lower effective tax rates than it's foreign operations, but GE has been reporting more of its profits overseas, where it's been paying higher taxes. (The fact that GE pays much lower taxes than the supposed US corporate tax rate is also instructive.) This trend of their reported profits shifting overseas where the corporate rates are effectively higher for GE counters the "conventional wisdom" about how taxes drive the investment decisions of a major global business:

Tuesday, August 23, 2011

The perils of ontological insecurity...

TalkingPointsMemo:

Who knew?

More HERE.

What are the four primary characteristics most associated with those Americans sympathetic to the Tea Party?

"Authoritarianism, ontological insecurity (fear of change), libertarianism and nativism."

So says one of the many findings in a study presented to the American Sociological Association on Monday.

Who knew?

More HERE.

Looking Backward: Report Card on the Bush Tax Cuts

|

| "I think clearly the evidence...uh, well..." |

Think Progress has posted a telling video of Tea Party-backed, first-term GOP Congressman Randy Hultgren at a town-hall being asked point blank by a constituent for evidence that the Bush tax cuts created jobs. He couldn't answer the question, stumbling over a non-response. Hultgren had good reason to stumble and evade the question. There is no evidence that shows the tax cuts drove job creation.

Monday, August 22, 2011

Jobs, jobs, jobs - "Size, Speed & Smarts" are the essentials for an effective jobs strategy

Jonathan Cohn at The New Republic:

President Obama’s plan to give a major economic speech after Labor Day means that, finally, Washington is going to have a serious conversation about creating jobs. And it can't come a moment too soon…

Of course, whether that conversation on jobs leads to action on jobs is more a question of politics than policy. Republicans want no part of anything with Obama’s name on it and, until that changes, very little can pass Congress.

Still, the best policy conversations start with what we should do, not with what we can (or can’t) do...

The case for taxing capital gains like any other income

James Stewart at The New York Times:

The notion that low capital gains tax rates are a good thing because they promote investment, lead to job creation, encourage people to sell assets without fear of tax consequences and actually raise total tax revenue is so entrenched in both parties that the idea of equalizing capital gains and ordinary income rates is barely mentioned or, when it is, is quickly denounced. It’s become a third rail of tax policy and electoral politics. “It’s now so woven into standard thinking that it’s become a cultural norm,” a prominent hedge fund official told me this week...

It does seem intuitive that lower taxes and thus potentially greater rewards would encourage risk-taking and investment, and surely at some rate high taxes can discourage any endeavor. But even some hedge fund and private equity officials concede that the argument for lower capital gains rates rests more on faith than science. “I’ve seen study after study that says lower capital gains rates have no impact on behavior,” the hedge fund official told me.

Friday, August 19, 2011

"Watching Armageddon From an Armchair"

Mother Jones blogger Kevin Drum offers this thought - a grim gut feeling undoubtedly shared these days by many who see the policy paralysis in the Beltway, while political fun and games play out on their TeeVees and the threat of a deepening economic crisis grows:

Watching the world slide slowly back into recession without a fight, even though we know perfectly well how to prevent it, is just depressing beyond words.

Our descendents will view the grasping politicians and cowardly bankers responsible for this about as uncomprehendingly as we now view the world leaders who cavalierly allowed World War I to unfold even though they could have stopped it at any time.

Shaping the 2012 Message: "Class Warfare" Done Right!

|

| "Congress won't work for the people!" |

Sometimes they become battles over the cultural and social anxieties that ordinary Americans suffer. Other times they are showdowns about middle-class anxieties when the free market fails. Normally, in the former sort of election, Republicans win. In the latter, Democrats do — as we saw in 2008, when the tide turned after John McCain said “the fundamentals of the economy are strong.

Must-See TeeVee: Jon Stewart's World of Class Warfare

Part 1 - Warren Buffett vs. The Wealthy

Part 2 - The Poor's Free Ride Is Over

Part 2 - The Poor's Free Ride Is Over

Recommended reading... but only with a stiff drink in hand.

Simon Johnson, former chief economist at the World Bank, suggests "it is increasingly likely that we will find ourselves in the midst of something nearly as traumatic (as the Great Depression) - a long slump of the kind seen with some regularity in the 19th century, particularly if presidential election-year politics continue to head in a dangerous direction."

Read his entire New York Times"Economix" column HERE, but pour yourself a little something to settle the nerves first.

Thursday, August 18, 2011

Help Wanted: A Jobs Bill That Can "Do The Job"

A major jobs bill is promised to be forthcoming from President Obama in September. Many Democrats are concerned that insider advisers are watering down the proposals, still hoping for some sort of compromises with Congress as "the art of the possible" or "good optics for independent voters."

In my view, the "compromise with the GOP" train never even got out of the station except as a signal of Democratic weakness in the current toxic Beltway environment. What was done with Bush tax cuts and deficit ceiling extension may have been preferable to the alternatives, but neither was forged as meaningful compromise.

Moving forward, the President must draw the clearest of lines between the Democratic agenda and the GOP's nihilistic, obstructionist assault on government . Former Labor Secretary Robert Reich offers a jobs bill strategy that would give the President a strong foundation for his 2012 campaign message - a bold and coherent alternative to address the economic concerns of anxious voters. We hope the White House is listening:

In my view, the "compromise with the GOP" train never even got out of the station except as a signal of Democratic weakness in the current toxic Beltway environment. What was done with Bush tax cuts and deficit ceiling extension may have been preferable to the alternatives, but neither was forged as meaningful compromise.

Moving forward, the President must draw the clearest of lines between the Democratic agenda and the GOP's nihilistic, obstructionist assault on government . Former Labor Secretary Robert Reich offers a jobs bill strategy that would give the President a strong foundation for his 2012 campaign message - a bold and coherent alternative to address the economic concerns of anxious voters. We hope the White House is listening:

The President is sounding like a fighter these days. He even says he’ll be proposing a jobs bill in September – and if Republicans don’t go along he’ll fight for it through Election Day (or beyond)...

The Economist has full confidence in presidential aspirant Michele Bachmann's cheap energy promise

Iowa GOP Straw Poll winner Michele Bachmann may appear clueless in most of her campaign spiel, but her promise to bring down gasoline prices is likely one "Bachmann economic plan" we can believe in according to The Economist's Washington correspondent:

REPRESENTATIVE Michele Bachmann, a candidate for the Republican presidential nomination, is getting a lot of flack for this statement:

"The day that the president became president gasoline was $1.79 a gallon. Look at what it is today," she says on tape at an event in Greenville, S.C., as chronicled by Politico. "Under President Bachmann, you will see gasoline come down below $2 a gallon again. That will happen."How on earth could she accomplish this, the critics ask. Where will she find the new supply? But supply is only one half of the equation. Petrol plunged from above $4 a gallon in July of 2008 to below $2 a gallon in January of 2009 thanks to the impact of economic collapse on oil demand. Ms Bachmann, meanwhile, was a strong opponent of an increase in the debt ceiling. Failure to raise the debt ceiling would have produced an immediate cut in government spending of 44%, leading to a larger output decline than was observed in 2008. Personally, I have total confidence that Ms Bachmann can bring back cheap petroleum, one way or another.

Wednesday, August 17, 2011

"It's the Aggregate Demand, Stupid!"

Conservative economics consultant Bruce Bartlett (he worked as an adviser to President Reagan) offers a column in the New York Times that puts the focus on what's holding back economic recovery. Hint - it's not businesses lacking the capital to re-invest because of high taxes, nor does it have anything to do with deficits. It's the fall in consumer demand - primarily because of high unemployment, depressed wages and the hit people took as equity in their homes disappeared due to the disaster caused by the financial sector in 2008.

Tuesday, August 16, 2011

Governor Good-Hair flushes out the Fed for traitors & threatens to rough 'em up if they tread into Texas

Rick Perry sees treachery and treason coming from the Federal Reserve Chairman Ben Bernanke...and, by implication, conservative economics guru Milton Friedman. A sign of the times in a Republican party where conservatism has been almost wholly supplanted by rabid reaction. The God 'n Guns Governor suggests a pretty ugly "Texas welcome" is in order for Chairman Ben.

Ezra Klein has it at WaPo "WonkBook":

|

| Milton Friedman can kiss gun-totin' Guv's butt! |

What potential policy maneuver is a major presidential candidate calling "almost treasonous"? Is it a) going to war without explicit authorization from Congress, b) doing nothing about the 15 million unemployed even as their temporary joblessness hardens into a structural disadvantage, or c) purchasing long-term Treasury debt in order to push interest rates down?

Jobs and infrastructure investment - Common Sense (and Space Aliens)

With a long, slightly dorky introduction that involves the unifying potential of space aliens(!), Rachel Maddow highlights the political and practical importance of focusing on jobs and rebuilding infrastructure - with comments from Paul Krugman, President Obama and an excellent, down-to-earth discussion with former Pennsylvania Governor Ed Rendell.

Visit msnbc.com for breaking news, world news, and news about the economy

Monday, August 15, 2011

Governor Good-Hair's Texas Miracle?

The most cogent comment about Texas Governor Rick Perry's character may well be the statement by a participant in a GOP primary opponent's focus group who - when presented with evidence that the Governor had given the green light to what increasingly looked like a wrongful death by lethal injection - responded: "It takes a lot of balls to execute an innocent man!"

We're not going to run with that. Titanic sticks to humbler tasks. We'll merely suggest that it takes a lot of balls to claim - as Perry's been doing - a Texas economic miracle on the Governor's watch. The first two chapters in what looks to be an ongoing series of recommended reading on Perry's jobs record - HERE. And HERE.

The economic (& theological) wisdom of Gov. Perry: "We're going through difficult economic times for a purpose - to bring us back to those Biblical principles of, you know, you don't spend all the money."

We're not going to run with that. Titanic sticks to humbler tasks. We'll merely suggest that it takes a lot of balls to claim - as Perry's been doing - a Texas economic miracle on the Governor's watch. The first two chapters in what looks to be an ongoing series of recommended reading on Perry's jobs record - HERE. And HERE.

The economic (& theological) wisdom of Gov. Perry: "We're going through difficult economic times for a purpose - to bring us back to those Biblical principles of, you know, you don't spend all the money."

"The best way to get people back to work...is through more government spending"

|

| Can't Democrats get out in front of this guy? |

There’s an article in today’s NYT on the economic debate within the White House. The print version—not the online one—contains this quote from an admin official:

“It would be political folly to make the argument that government spending equals jobs.”

Taxes on billionaires are a joke

Channeling the ancient comedian's quip in a New York Times op-ed, billionaire Warren Buffet analyses the fact of super-low taxes on the mega-rich and says, "Take my income... Please!":

While the poor and middle class fight for us in Afghanistan, and while most Americans struggle to make ends meet, we mega-rich continue to get our extraordinary tax breaks. Some of us are investment managers who earn billions from our daily labors but are allowed to classify our income as “carried interest,” thereby getting a bargain 15 percent tax rate. Others own stock index futures for 10 minutes and have 60 percent of their gain taxed at 15 percent, as if they’d been long-term investors.

Sunday, August 14, 2011

The jobs crisis is a national emergency

Former Council of Economic Advisors chair Christina Romer points to the real crisis we're in. It's lack of jobs, not "too much government spending." Put simply, we're not spending nearly enough to attack unemployment. Further, "structural unemployment" arguments to explain the current crisis are rationalizations to do nothing. Romer looks back to World War II and explains why - if we're serious about economic recovery - we need measures that will, yes, add to the deficit to fight unemployment. Why? Because it's worked before:

(F)iscal stimulus can help a depressed economy recover — an idea supported by new studies of the 2009 stimulus package. Additional short-run tax cuts or increases in government investment would help deal with our unemployment crisis.

Friday, August 12, 2011

Flying Pigs: David Frum's "Forum" takes on the Fed's inflation hawks and looks to Sweden's Central Bank for sensible economic priorities and policies

This commentary may seem like pretty nerdy econ-speak, but it's well worth wading through - both for the confirmation that the inflation hawks on the Federal Reserve "aren't even wrong" - in that their preoccupations are nonsense issues in the current economic climate - and the (welcome!) spectacle of neo-conservative "wunderkind" David Frum (whose hair is on fire at this very moment regarding the descent into near-total idiocy of his GOP confreres) giving apparent blessing to lessons that might be learned from macro-economic policies in the "socialist hell-hole" of Sweden. The post at "FrumForum" is entitled - accurately - Fed Hawks Turn on the Unemployed:

Inflation isn't always evil

|

| The Good Old Days! |

In our current debt-induced economic straits a higher inflation target will help solve some of the intractable problems of too many people owing too much money on undervalued assets:

In a column in The Financial Times this week, Ken Rogoff, the Harvard economist, suggested central bankers consider “the option of trying to achieve some modest deleveraging through moderate inflation of, say, 4 to 6 percent for several years.”

Mr. Rogoff conceded that “any inflation above 2 percent may seem anathema to those who still remember the anti-inflation wars of the 1970s and 1980s.”...

Thursday, August 11, 2011

People support higher taxes to reduce the deficit

|

| Grover Norquist rules our world. |

The list is HERE, at Bruce Bartlett's "Capital Gains and Games" blog.

"A long malaise seems like the optimistic scenario"

Nobel Prize-winner and former chief economist at The World Bank, Joseph Stiglitz writing in The Financial Times offers a bleak appraisal of the moment: the US can borrow at extremely low rates to make the investments in infrastructure and targeted job-creation that could jump-start economic growth (which is also the key to longer-term deficit reduction), but the politics of austerity make any effective policies or optimistic scenarios impossible:

Pre-crisis, America, and to a large extent the world economy, was sustained by a bubble. The breaking of the bubble has left a legacy of excess leverage and real estate. Consumption will therefore remain weak and austerity on both sides of the Atlantic now ensures the state will not fill the void. Given this, it is not surprising that companies are unwilling to invest – even those that can get access to capital…

Tuesday, August 9, 2011

"Why didn’t the stock market go up?"

"Cheap Talk" on the apparent paradox of Treasury bonds becoming more sought after as a secure investment in the wake of their "downgrade" by the "geniuses" at S&P:

You might have thought it obvious that the stock market would go down after S&P downgraded US government debt. The bad news about US debt made investors worry, and worried investors are usually less enthusiastic about holding stocks.

But there is something wrong with this view.

The GOP is bad for business

|

| The GOP: flying on a wing-nut and a prayer. |

James Suroweicki, at The New Yorker, argues that the country would be much better off if the Republicans abandoned the political hostage-taking and the Tea Party "crazy train" - and went back to the more respectable and risk-averse business of simply being corporate lapdogs:

Moody's Mood

That other "big three" ratings agency - which for the record, was just as complicit as the execrable Standard & Poors in aiding and abetting the junk mortgage markets that triggered financial crisis - has affirmed that the United States has “unmatched access to financing, meaning that the U.S. government can support higher debt levels than other governments” and rates the country "AAA."

Excerpts of the basis of their "AAA" assessment, via New York Times "Economix":

Excerpts of the basis of their "AAA" assessment, via New York Times "Economix":

Sunday, August 7, 2011

The impact of "starving the beast" on unemployment

Think Progress: "If government payrolls were the same today as they were back in 2009, the unemployment rate would be significantly lower, standing at 8.4 percent, instead of the current 9.1 percent."

Krugman does the math - deficit hysteria doesn't add up

In the wake of the S&P downgrade, the Nobel Prize-winning economist and New York Times columnist Paul Krugman looks at the numbers behind the deficit hype:

Amid all the debt hysteria, it’s worth taking a look at the actual arithmetic here — because what this arithmetic says is that the size of the deficit in the next year or two hardly matters for the US fiscal position — and in fact the size over the next decade is barely significant.

Saturday, August 6, 2011

The Triple-AAA Arrogance of Standard & Poors

Former Labor Secretary Robert Reich:

S&P has downgraded the U.S. because it doesn’t think we’re on track to reduce the nation’s debt enough to satisfy S&P — and we’re not doing it in a way S&P prefers.

Here’s what S&P said: “The downgrade reflects our opinion that the fiscal consolidation plan that Congress and the administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government’s medium-term debt dynamics.” S&P also blames what it considers to be weakened “effectiveness, stability, and predictability” of U.S. policy making and political institutions.

Pardon me for asking, but who gave Standard & Poor’s the authority to tell America how much debt it has to shed, and how?

Friday, August 5, 2011

More evidence that nonsense supply-side mantras like "corporate tax cuts" aren't going to move the economy

Clearly the problem driving a weak recovery - in serious danger of a "double-dip" - isn't that corporations don't have enough capital to make the sorely needed investments in jobs:

Source: BEA

Source: BEA

Economist Jared Bernstein:

Source: BEA

Source: BEAEconomist Jared Bernstein:

How is this picture consistent with an economy and job market hovering at stall speed? A lot of these firms are able to sell into (and create jobs in) foreign, emerging markets, where growth has been reliably solid in recent years. Others have found ways to squeeze productivity gains out of their incumbent workforce, able to meet current levels of weak demand without adding workers.The only thing that will get these guys off of their piles of cash is a steady increase in domestic demand - and I don't see that coming soon without the government doing a major jump-start. An infrastructure bank that could begin to green-light immediate repairs and large-scale new initiatives - something that both the labor unions and the Chamber of Commerce have come to agree on - is the only politically feasible proposal in this direction I've seen to date.

Double-Dippin'...and where do we go from what feels like "nowhere"?

This morning we have a banquet of bad news, triggered by a dive in the markets, days after the end of a debt ceiling hostage drama was expected to restore "confidence."

Floyd Norris at the New York Times says what no one wants to hear:

Floyd Norris at the New York Times says what no one wants to hear:

It has been three decades since the United States suffered a recession that followed on the heels of the previous one. But it could be happening again. The unrelenting negative economic news of the past two weeks has painted a picture of a United States economy that fell further and recovered less than we had thought.On the heels of the Obama White House's former Council of Economic Advisors' head Larry Summers giving us a one-in-three chance of a double dip into another full recession, Business Week offers this bit of gloom from President Reagan's old CEA chief, along with worries of our current Fed chairman:

“This economy is really balanced on the edge,” Harvard University economist Martin Feldstein said in a Bloomberg TV interview on Aug. 2. “There’s now a 50 percent chance that we could slide into a new recession.” Even Federal Reserve Chairman Ben Bernanke has referred in speeches to the risk of an economic stall...Ezra Klein looks behind the Dow Jones drop, at the much more alarming weaknesses not just in our economy but in our politics - and an inability to conduct an even minimally informed public conversation on the problems we face:

... the Dow Jones isn’t diving because spending has risen, deficits have grown or stimulus policy has changed. It’s diving because of forces Washington can’t control, and in many cases, doesn’t understand very well. How many members of Congress do you think could give a coherent account of what has happened to oil or steel prices over the last three years? Or what’s happening in the Eurozone? Or to the yuan?

A dramatic gap has opened between the economy as Washington sees it -- and wants to intervene in it -- and the economy that actually exists.

Thursday, August 4, 2011

Reality trumps hyperbole

|

| Mitch: "A snapshot, not a cartoon." |

“I think some of our members may have thought the default issue was a hostage you might take a chance at shooting. Most of us didn’t think that. What we did learn is this — it’s a hostage that’s worth ransoming."

So the dangerously venal were mere accomplices to the crazy terrorists? Good to know.

The Good, The Bad and The Ugly...

Lawrence Summers in the Washington Post outlines his 3-way take on The Deal:

Relief. There will be no default; no economy-damaging short-run austerity; no attack on the nation’s core social protection programs or universal health care; and no repeat, for at least 15 months, of the recent shabby spectacle. All of this was in doubt just a few days ago. It is no small thing for the administration to have reached an agreement that does no immediate harm. And it may well be that no better agreement was achievable given the political dynamics in Congress.Emphasis added!!! Where does Summers think we can go from here?

Cynicism. Objective observers would forecast larger U.S. budget deficits in the out-years than would have been predicted a few months ago. The economic forecast has deteriorated, and it is reasonable to estimate that even a half-a-percent reduction in growth averaged over 10 years adds more than a trillion dollars to the national debt in 2021...

Economic anxiety. The issues pressing the United States today are much more about jobs and a growth deficit than an excessive budget deficit... On the current policy path, it would be surprising if growth were rapid enough to reduce unemployment even to 8.5 percent by the end of 2012. A substantial withdrawal of fiscal stimulus will occur when the payroll tax cuts expire at the end of the year. With growth at less than 1 percent in the first half of this year, the economy is effectively at a stall... The indicators suggest that the economy has at least a 1-in-3 chance of falling back into recession if nothing new is done to raise demand and spur growth.

Wednesday, August 3, 2011

We defer to...yes...David Frum, who judges his "enemies" right!

Although my own view is that the first question posed here is more complicated than inferred, this comment by Bush speechwriter and neo-conservative stalwart David Frum is startling in the amount of ground it gives:

In February 1982, Susan Sontag made a fierce challenge to a left-wing audience gathered at New York’s Town Hall:

Imagine, if you will, someone who read only the Reader’s Digest between 1950 and 1970, and someone in the same period who read only The Nation or The New Statesman. Which reader would have been better informed about the realities of Communism? The answer, I think, should give us pause. Can it be that our enemies were right?Posing that question won Sontag only boos from an audience that the New York Times described as “startled.” Yet the question has only gained power over the intervening years. It contributed to the rise of a healthier, more realistic left much less tempted to make excuses for “progressive” dictatorships than the left of the last generation. If Hugo Chavez has any defenders on the contemporary American left, I haven’t heard of them.

Think of Susan Sontag as you absorb the horrifying revised estimates of the collapse of 2008 from the Commerce Department. Two years ago, Commerce estimated the decline of the US economy at -0.5% in the third quarter of 2008 and -3.8% in the fourth quarter. It now puts the damage at -3.7% and -8.9%: Great Depression territory.

Impact of "The Deal" on Jobs

Expected effects of the debt ceiling deal's spending cuts, combined with the impact on consumer demand of not extending unemployment benefits or cuts in payroll taxes as part of the "compromise."

Economic Policy Institute

Tuesday, August 2, 2011

Monday, August 1, 2011

I heard the news today - Oh Boy!

Visit msnbc.com for breaking news, world news, and news about the economy

"Lousy Negotiating Skills Are Not the (Main?) Problem"

Jared Bernstein, formerly VP Joe Biden's chief economic advisor and currently a Senior Fellow at the Center on Budget and Policy Priorities offers a "balanced" view of a deal that's hardly "balanced":

America wakes up this morning with the specter of a self-inflicted national default behind us, at least until 2013, according to the deal announced last night.

That is unequivocally a good thing for our economy not to mention our national sanity. It’s a good thing in the same way that ceasing to bang yourself on the head with a hammer would be a good thing.

But really, what the h-e-double-hockey-sticks (sorry, I’ve got young kids) was that about??!!

If your conclusion is that Democrats got rolled because the President is a lousy negotiator, I disagree.

Not on his negotiating skills…as someone said in comments, I wouldn’t want him in the auto showroom with me when I’m bargaining for a better price. I disagree that better negotiating skills would have made a big difference. The problem goes much deeper.

The best of all possible worlds in the wake of "The Deal" ?

Jon Chait at The New Republic speculates that this debt ceiling brouhaha and the GOP's penchant for all-or-nothing "negotiating" might have a much more optimal result than anyone currently is willing to even discuss:

If Obama wins reelection, he can refuse to extend any tax cuts on income over $250,000. That will prompt Republicans to refuse to extend tax cuts on any income under $250,000 (as they signaled last December, and in keeping with their longstanding priorities, which deem the middle class tax cuts mere sweetener to get the tax cuts for the rich they really want.) Then the tax cuts expire while Obama blames Republicans for holding the (popular) universal tax cuts hostage to the (unpopular) tax cuts that only benefit the rich.Assuming the economy has limped into some sort of recovery track by 2013, allowing an automatic default to Clinton-era tax rates would be the simplest path in returning to sane fiscal policy.

The Deal - Two views

A Wall Street heavy reacts, via The New York Times:

Paul Krugman, one of the President's severest critics in the debt-ceiling negotiations from the liberal end of the spectrum :

Last week brought the disconcerting news that the economy grew no faster than the population during the first six months of the year, in part because of spending cuts by state and local governments. Now the federal government is cutting, too.

“Unemployment will be higher than it would have been otherwise,” Mohamed El-Erian, chief executive of the bond investment firm Pimco, said Sunday on ABC. “Growth will be lower than it would be otherwise. And inequality will be worse than it would be otherwise.”

He added, “We have a very weak economy, so withdrawing more spending at this stage will make it even weaker.”

Paul Krugman, one of the President's severest critics in the debt-ceiling negotiations from the liberal end of the spectrum :

What Republicans have just gotten away with calls our whole system of government into question. After all, how can American democracy work if whichever party is most prepared to be ruthless, to threaten the nation’s economic security, gets to dictate policy? And the answer is, maybe it can’t.

Subscribe to:

Posts (Atom)