One of the more desperate candidates for the GOP's presidential nomination, former Minnesota Governor Tim Pawlenty, has doubled down on the party's Tax Cuts Uber Alles dogma and equated his crank faith-based economic strategy with belief in America.

Actually he's "tripled down" on massive tax giveaways structured to further enrich the economic elite:

According to

Bloomberg/Businessweek:

Pawlenty’s $11.6 trillion tax-cut plan, which reduces rates on income, capital gains, interest, estates and dividends, is almost three times larger than the proposals endorsed by House Republicans...Almost half of the benefits would flow to taxpayers in the top 1 percent of income distribution, or those earning more than $593,011 in 2013...

Pawlenty...said 5 percent annual average economic growth would help make up the revenue gap... (S)uch growth would be driven by the tax plan as well as by spending cuts, regulatory overhaul and monetary policy changes that Pawlenty is proposing.

So we're getting a version of the "tax cuts pay for themselves" mantra on steroids. Paul Krugman, NYT's columnist and Nobel Prize-winning economist at Princeton,

looks at Pawlenty's "plan" and the promise - 5% economic growth driven by massive reductions in taxes:

Tim Pawlenty — who has turned out to be a much bigger fool than I or, I think, anyone imagined — replies to

criticism of his claim that he can get 10 years of GDP growth at 5 percent:

Obama’s economic team doesn’t have a plan, so their spokespeople attack ours. The idea that they don’t believe in the American people enough to say that we can grow the economy at 5% GDP really says everything. You have to wonder if in fact Obama’s grand plan is that we don’t grow at all — and if so — he and the central planners are doing a great job of that.

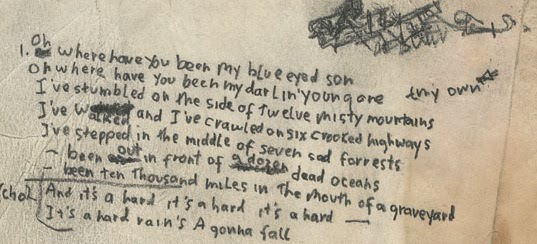

Well, here are 10-year growth rates starting with 1929-39:

Bureau of Economic Analysis Data here. Except for the big jump from the depths of the Great Depression to the height of World War II, we have never had a decade of growth at 5%.

What’s also notable in this figure is the invisibility of all the supposed economic miracles we hear about. Saint Reagan was supposed to have revitalized the economy; can’t see it here. All you can really see is that the 60s were very good, and the recent slump has been very, very bad.

At least we can thank Pawlenty for erasing any doubts that he's one of the biggest fools out there - even by GOP presidential aspirant standards (or lack of them.)